Home Office Tax Deduction Norway . when you work in norway you need a tax deduction card. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. It is important to provide your postal address. read more about the norwegian home office tax rules here. Working from home in denmark. the amended home office regulation is issued to make it easier to handle employees working from home. Expenses related to a room in your home that you exclusively use for working, such as. deductions for home office expenses. as a main rule, the working environment act has applied even to work performed from home, unless comprised.

from wesuregroup.com

read more about the norwegian home office tax rules here. the amended home office regulation is issued to make it easier to handle employees working from home. as a main rule, the working environment act has applied even to work performed from home, unless comprised. Working from home in denmark. deductions for home office expenses. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. Expenses related to a room in your home that you exclusively use for working, such as. It is important to provide your postal address. when you work in norway you need a tax deduction card.

Home Office Tax Deduction Tips for Small Business Owners

Home Office Tax Deduction Norway as a main rule, the working environment act has applied even to work performed from home, unless comprised. when you work in norway you need a tax deduction card. Working from home in denmark. read more about the norwegian home office tax rules here. the amended home office regulation is issued to make it easier to handle employees working from home. as a main rule, the working environment act has applied even to work performed from home, unless comprised. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. Expenses related to a room in your home that you exclusively use for working, such as. It is important to provide your postal address. deductions for home office expenses.

From www.dreamstime.com

Home Office Tax Deduction Information on Laptop Screen. Stock Photo Home Office Tax Deduction Norway read more about the norwegian home office tax rules here. Expenses related to a room in your home that you exclusively use for working, such as. the amended home office regulation is issued to make it easier to handle employees working from home. It is important to provide your postal address. deductions for home office expenses. . Home Office Tax Deduction Norway.

From www.linkedin.com

Home Office Tax Deductions How Does It Work? Home Office Tax Deduction Norway under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. read more about the norwegian home office tax rules here. when you work in norway you need a tax deduction card. Working from home in denmark. the amended home office regulation is issued to make it easier to handle employees. Home Office Tax Deduction Norway.

From hardgeconnections.com

Home Office Tax Deduction How Does It Work? Hardge Connection Home Office Tax Deduction Norway Working from home in denmark. as a main rule, the working environment act has applied even to work performed from home, unless comprised. the amended home office regulation is issued to make it easier to handle employees working from home. read more about the norwegian home office tax rules here. It is important to provide your postal. Home Office Tax Deduction Norway.

From www.houseopedia.com

Understanding the Home Office Tax Deduction Houseopedia Home Office Tax Deduction Norway Expenses related to a room in your home that you exclusively use for working, such as. deductions for home office expenses. as a main rule, the working environment act has applied even to work performed from home, unless comprised. Working from home in denmark. It is important to provide your postal address. when you work in norway. Home Office Tax Deduction Norway.

From barszgowie.com

Home Office Tax Deduction A Comprehensive Guide Home Office Tax Deduction Norway under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. when you work in norway you need a tax deduction card. as a main rule, the working environment act has applied even to work performed from home, unless comprised. deductions for home office expenses. read more about the norwegian. Home Office Tax Deduction Norway.

From www.ipcstore.com

Home Office Tax Deductions for Small Business and Homeowner Home Office Tax Deduction Norway Expenses related to a room in your home that you exclusively use for working, such as. as a main rule, the working environment act has applied even to work performed from home, unless comprised. when you work in norway you need a tax deduction card. deductions for home office expenses. the amended home office regulation is. Home Office Tax Deduction Norway.

From workinginnorway.blogspot.com

Working in Norway How to do a tax return in Norway Home Office Tax Deduction Norway the amended home office regulation is issued to make it easier to handle employees working from home. Working from home in denmark. read more about the norwegian home office tax rules here. when you work in norway you need a tax deduction card. under the scheme, you as employer must deduct 25 percent tax, including 8.2. Home Office Tax Deduction Norway.

From wesuregroup.com

Home Office Tax Deduction Tips for Small Business Owners Home Office Tax Deduction Norway deductions for home office expenses. the amended home office regulation is issued to make it easier to handle employees working from home. when you work in norway you need a tax deduction card. Working from home in denmark. Expenses related to a room in your home that you exclusively use for working, such as. read more. Home Office Tax Deduction Norway.

From www.youtube.com

Home Office Tax Deduction How to Write Off Home Expenses YouTube Home Office Tax Deduction Norway Expenses related to a room in your home that you exclusively use for working, such as. Working from home in denmark. deductions for home office expenses. when you work in norway you need a tax deduction card. as a main rule, the working environment act has applied even to work performed from home, unless comprised. It is. Home Office Tax Deduction Norway.

From www.ramseysolutions.com

Working From Home? Home Office Tax Deduction Ramsey Home Office Tax Deduction Norway as a main rule, the working environment act has applied even to work performed from home, unless comprised. deductions for home office expenses. Working from home in denmark. the amended home office regulation is issued to make it easier to handle employees working from home. under the scheme, you as employer must deduct 25 percent tax,. Home Office Tax Deduction Norway.

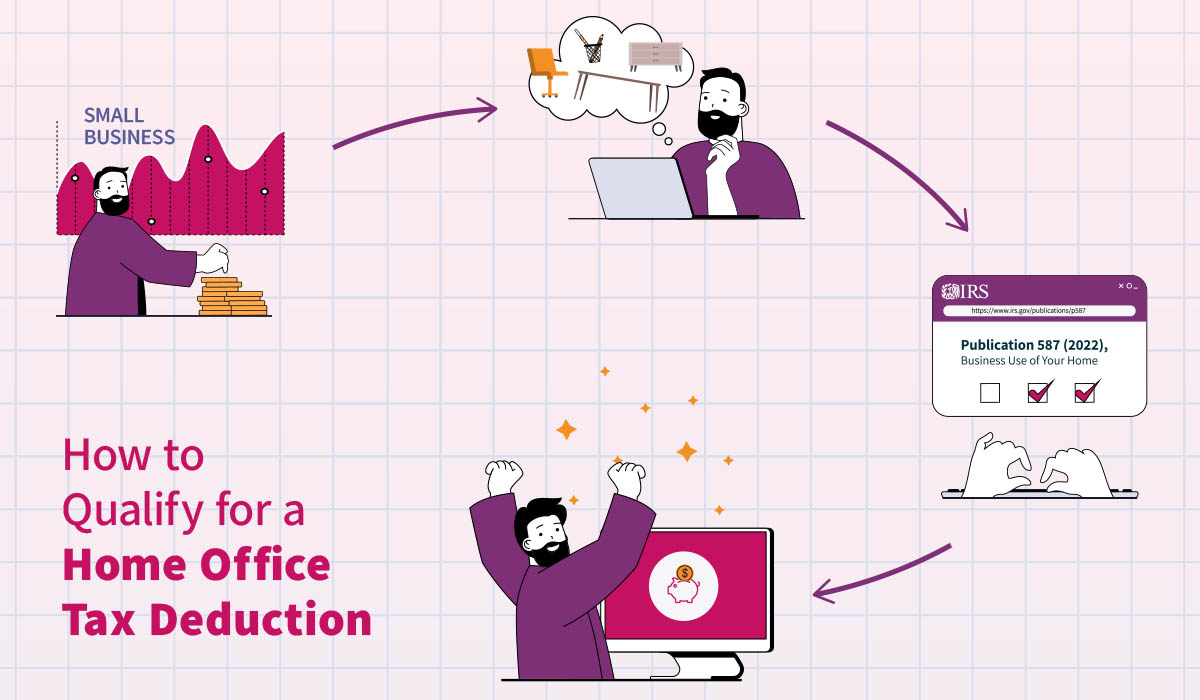

From www.visme.co

How to Qualify For HomeOffice Tax Deduction Infographic Template Visme Home Office Tax Deduction Norway the amended home office regulation is issued to make it easier to handle employees working from home. read more about the norwegian home office tax rules here. Expenses related to a room in your home that you exclusively use for working, such as. It is important to provide your postal address. as a main rule, the working. Home Office Tax Deduction Norway.

From flyfin.tax

How the Home Office Deduction Works for Freelancers FlyFin Home Office Tax Deduction Norway as a main rule, the working environment act has applied even to work performed from home, unless comprised. when you work in norway you need a tax deduction card. the amended home office regulation is issued to make it easier to handle employees working from home. It is important to provide your postal address. under the. Home Office Tax Deduction Norway.

From www.kiplinger.com

Home Office Tax Deduction Rules for 2023 Kiplinger Home Office Tax Deduction Norway deductions for home office expenses. when you work in norway you need a tax deduction card. the amended home office regulation is issued to make it easier to handle employees working from home. Expenses related to a room in your home that you exclusively use for working, such as. It is important to provide your postal address.. Home Office Tax Deduction Norway.

From printableliblayette.z13.web.core.windows.net

Simple Deduction For Home Office Home Office Tax Deduction Norway read more about the norwegian home office tax rules here. when you work in norway you need a tax deduction card. Expenses related to a room in your home that you exclusively use for working, such as. Working from home in denmark. deductions for home office expenses. under the scheme, you as employer must deduct 25. Home Office Tax Deduction Norway.

From www.pinterest.com

Work from home? Choose from two methods of home office deduction Home Office Tax Deduction Norway read more about the norwegian home office tax rules here. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. when you work in norway you need a tax deduction card. Expenses related to a room in your home that you exclusively use for working, such as. Working from home in. Home Office Tax Deduction Norway.

From www.irvinebookkeeping.com

IRS Home Office Tax Deduction for Small Business Owners Help you Home Office Tax Deduction Norway the amended home office regulation is issued to make it easier to handle employees working from home. deductions for home office expenses. read more about the norwegian home office tax rules here. when you work in norway you need a tax deduction card. as a main rule, the working environment act has applied even to. Home Office Tax Deduction Norway.

From virblife.com

Can You Take a Home Office Tax Deduction? Home Office Tax Deduction Norway Working from home in denmark. Expenses related to a room in your home that you exclusively use for working, such as. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. when you work in norway you need a tax deduction card. deductions for home office expenses. as a main. Home Office Tax Deduction Norway.

From www.dreamstime.com

Home Office Tax Deduction on Blue Stock Photo Image of office Home Office Tax Deduction Norway as a main rule, the working environment act has applied even to work performed from home, unless comprised. deductions for home office expenses. Expenses related to a room in your home that you exclusively use for working, such as. under the scheme, you as employer must deduct 25 percent tax, including 8.2 percent national insurance. Working from. Home Office Tax Deduction Norway.